Understanding Interwetten Wettsteuer: A Comprehensive Guide to Betting Tax Regulations

Introduction to Wettsteuer

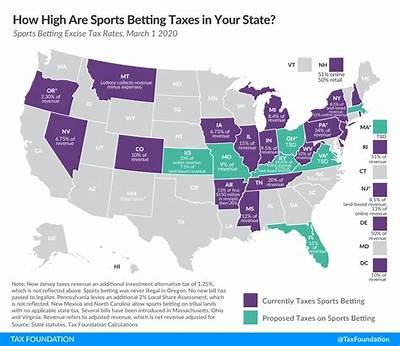

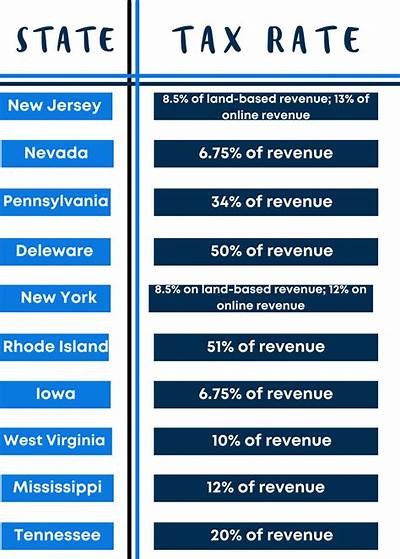

As the popularity of online betting continues to rise, regulatory bodies around the world are implementing various taxation measures to ensure fair play and revenue generation. One of the key aspects of these regulations in Germany is the Wettsteuer, a betting tax that is levied on sports and other types of betting activities. This article aims to provide a comprehensive guide to Wettsteuer, particularly focusing on its implications for bettors using platforms like Interwetten. The Wettsteuer, or betting tax, was introduced in Germany to regulate the growing online betting market. This tax applies to all licensed betting operators and affects both the operators and the end users—bettors. It is levied at a standard rate of 5% on the total stake placed by a bettor. It is crucial for bettors to understand how this tax works and how it influences their betting experience. When a bettor places a bet on a platform such as Interwetten, the operator is obligated to deduct the Wettsteuer before determining the winnings. This means that the final payout the bettor receives is lower than it would be without the tax. For instance, if you place a bet of €100 on a selection with odds of 2.0, the potential winnings would ordinarily be €100. However, with the Wettsteuer applied, your actual winnings would be calculated as follows: Potential winnings: €100 The introduction of Wettsteuer has significant implications for bettors. Firstly, it reduces the overall profitability of betting, as players receive a lesser amount in winnings due to taxes. Bettors must now factor in this tax when placing their bets, leading to potentially less aggressive betting strategies. Additionally, frequent bettors might find the tax burdensome, especially if they rely on smaller margins to make a profit. When analyzing Wettsteuer, it’s useful to compare it to betting tax regulations in other countries. In countries like the UK, there is a different regulatory framework, with operators paying taxes on their profits rather than directly affecting the bettor. This leads to varying experiences for bettors around Europe, who might enjoy tax-free betting in some jurisdictions while facing rigorous taxes in others.

Are There Ways to Avoid Wettsteuer?

While it may be tempting to seek loopholes to avoid the Wettsteuer, it is crucial to remember that evading taxes is illegal and could lead to significant penalties. However, bettors might find certain promotions or bonus offers provided by betting platforms that can effectively offset the impact of the tax. These promotions can come in the form of enhanced odds or cashback offers, which may help to mitigate the financial burden imposed by Wettsteuer.

The Role of Licensed Operators

The responsibility to comply with Wettsteuer lies predominantly with licensed betting operators in Germany. Platforms like Interwetten, which are fully licensed, deduct the tax at the point of stake placement. This practice not only ensures compliance with German law but also guarantees a level of security and trust for the bettors, knowing that they are interfacing with a regulated entity.

Final Remarks

Understanding Wettsteuer is essential for any bettor engaged with online platforms like Interwetten. Knowledge of how this tax affects potential winnings allows for better financial planning and strategic betting. By staying informed about the tax regulations and their implications, bettors can make more educated decisions and optimize their betting experiences. As the regulatory landscape evolves, staying updated on changes in Wettsteuer is crucial for every serious bettor.

Tags

Wettsteuer (5% of €100): €5

Net winnings: €95